How to Set Up & Manage ACH Authorization Forms in 2021

Cardless, cashless, electronic, online payments like ACH are not the future. It’s the present, right now. Availability and adoption for this type of payment got a big push from the pandemic too.

If you’re a business owner, supplier, or service provider, your goal is to simplify any payment process to get more clients, customers, or consumers, while ensuring security and liability for both parties involved.

But in order to set up a direct payment option like ACH for your customers, an ACH Authorization Form signed by them is required before you even begin taking payments.

Taking this measure is not just to make any charges official, it will safeguard your business in case of legal disputes in the future.

Although offering a convenient payment option for your audience, as ACH Debits or ACH Credits, can boost sales and orders, you want to cut off any red tape – and risks - to gain productivity and scalability.

In this article, we’ll show you how MightyForms can take care of the entire ACH Authorization Forms process for your business. From building a custom and automated ACH Authorization Form in a few minutes to easily and safely managing and archiving signed forms, you’ll never worry about this again in 2021 onwards. Let’s get to it.

What is ACH Payment System

Also known as a direct payment or direct deposit, an Automated Clearing House (ACH) payment system is a computer-based electronic network for processing financial transactions. Funds are transferred from one bank account to another by a centralized system.

It enables anyone to electronically collect payments for either single-entry (one-off) or recurring (ongoing) payments. From salaries, purchases, donations, to sending money to friends and family, everything can be safely transferred electronically by the ACH Network.

According to NACHA (National Automated Clearing House Association), 26.8 billion payments were made on the ACH Network in 2020, an increase of 8.2% over 2019, moving more than $61.9 trillion between bank accounts across the US.

It has definitely kept vital payments safely moving in America during the challenging times of the pandemic. Not to mention that 68% of all eligible citizens received their Stimulus Payments through ACH Network.

Two main types of ACH payments:

Credit transfer: transfer of funds between accounts of different banks

Direct debit: payment by directly debiting charges from the customer’s checking or saving accounts.

ACH payments are usually used for person-to-person (P2P), business-to-customer (B2C), or business-to-business (B2B) payments.

The most common uses for ACH payments are for utility bills, mortgage, loans, direct deposit of payroll, income tax refunds, subscription and streaming services, retail and vendor payments.

ACH Payment Benefits

Honestly, there are so many electronic online payment options right now, from contactless and cardless to digital wallets and payment apps, that cold, hard cash will soon be retired.

ACH Payments are far from being a new or modern option (it’s been around since the late 1960s!), although a crucial part of the process can totally be made with the help of no-code technology now. But more on ACH Authorization Forms by MightyForms ahead.

So even though an “old” electronic payment option, ACH Payments have been picking up steam more than ever since last year. And it has stood the test of time by offering very particular benefits:

- ACH debits and transfers take less time to be processed than cash or check payments;

- ACH payments cannot get lost;

- ACH fees are much cheaper than credit card processing fees (for both seller and buyer);

- ACH payments are frictionless and automatic, no need for paper or online bills;

- ACH payments are a safer alternative for those customers who prefer not to divulge credit card information online;

- No need to update expired credit card information, especially for recurring payments;

- ACH payments reduce human errors and time spent on payment processing;

- ACH payments reduce the default rate by lack or failure of payment, improving cash flow.

What is ACH Authorization Form

To begin taking payments by the ACH system, all you need is to partner with a payment processor. Usually the very bank you keep your business accounts with already provides this service.

As I mentioned before, ACH payments are a straightforward financial transaction, but it does require prior proof of authorization in order to validate customer’s consent for future charges.

Even if consent was expressed in some informal way, an ACH Authorization Form is the norm to ensure the legitimacy of an ACH debit permission.

The ACH Authorization Form Format

Although there’s no “official” nor standardized format or layout for ACH Authorization Forms, there are some mandatory elements.

The level of details will depend on the purpose of the transaction, but every ACH Authorization Form must meet the requirements outlined by NACHA and it must contain:

- Customer or Business Name

- Email address (for online payments)

- Bank Name

- Account Number and Type (Savings or Checking)

- Routing Number

- Amount (or range of amounts)

- Type of transaction: single or recurring charge (in this case it must specify date and frequency)

- A statement giving permission for all future debits and a disclaimer where it states that it can be revoked within a required notice period (please see example below)

“Hereby, I authorize NAME OF COMPANY, to electronically debit my account according to the information stated in this ACH Authorization Form. I understand I must notify NAME OF COMPANY at least five business days in advance in order to request the revoking of this authorization.”

- Signature field

The ACH Authorization Form can be manually completed on paper or filled out online. A copy should be given to the customer and companies are recommended to retain the signed form for at least two years.

Paperless ACH Authorization Forms

Just because ACH Network accepts paper forms, it doesn’t mean it should be. And paper forms are definitely not the most practical or safest method for collecting or managing ACH Authorization Forms.

Paper forms require space for filing and storing and they can’t be accessed remotely. Worse yet, it can get damaged or lost. Not to mention that information written by hand can be illegible leading to a waste of time and money.

And If you’re worried about the legitimacy of electronic signatures, rest assured that they are legally binding in the US by the Electronic Signatures in Global and National Commerce (ESIGN) Act of 2000.

The ESIGN Act grants legal recognition of digital signatures if all parties involved agree to use and sign any type of electronic document. This means that an electronic signature on an ACH Authorization Form is worth it just as a written one on paper.

Why ACH Authorizations Forms are Important

The ACH payment system is very convenient, inexpensive, and reliable for both parties, the payee and the payer. But as more people adopt this type of payment, the more it attracts cyber fraud attempts. And scams are attempted at each end of the deal.

In an effort to reduce unauthorized ACH debits, the Federal Reserve applies a $4.50 fee for each unauthorized transaction.

But the repercussions can get far worse if a legal dispute (not to mention criminal) is requested by the customer for improper authorization. Which may not necessarily mean unauthorized. Here are the main reasons for ACH Disputes (also called ACH Returns or Chargebacks):

- Proper authorization was not obtained prior to the ACH debit

- The debit amount was different than the agreed value

- The transaction was processed on a different date than the agreed one

Not only customers can dispute ACH payments. Some sort of fraud can be attempted on merchants too, like customers stating false claims in order to avoid paying for a product or service. Or even a “friendly fraud”, when the customer has insufficient funds for the ACH debit.

Can you see why an ACH Authorization Form acts as a legally binding agreement for this type of financial transaction? And how ensuring accuracy and security for the collection and management of ACH Authorization Forms are crucial?

How to Set Up and Manage ACH Authorizations Forms

If ACH Payments are such a safe, easy and fast payment option, then it only makes sense to handle ACH Authorization Forms with the same approach.

Getting paid is the main objective here, absolutely. But ensuring a smooth, hassle-free, and smart solution when it comes to collecting and managing the ACH Authorization Forms can’t be dismissed or improvised.

MightyForms is a form builder that requires no coding knowledge and it can help you to set up your ACH Authorization Form in no time (yeah, forget about improvising one on Word).

Moreover, all forms created by MightyForms are fully customized, automated, fillable, signable, and responsive on any device. Our forms are packed with further features and functionalities to help your business become not only compliant with ACH rules but more efficient at it.

By the way, if you’re planning to offer a range of payment options to your customers, MightyForms is a verified Stripe partner. Just as a side note, in case you want to learn more about online payment and provide a Stripe Payment Form as well.

Here’s how MightyForms takes care of every stage of the ACH Authorization Form process:

1. Designing an ACH Authorization Form

MightyForms allows you to build your form either from scratch or from a free ACH form template. Since there’s no official ACH layout, you can create yours just as it suits your purpose and business identity, incorporating your logo, for example. You can easily add, reposition, or resize any field. Fonts, colors, and backgrounds are fully customizable as well.

In case you already have an existing ACH Authorization Form as a paper document or as a PDF file and would like to import it and convert it to an editable and customizable MightyForms form, our Support Team will take care of that for you.

Besides including all mandatory ACH elements and any additional information you must state on your form, a functional signature field is key. Actually, you can add the signature field and mark it as required to avoid any unsigned submission. Under Advanced Settings, you can select how you’d like it signed: Draw Signature (with a cursor); Type Signature; or Upload Existing File. Any e-signature format is legally admissible by both ESIGN Act and NACHA.

ACH Authorization Forms hold sensitive information and MightyForms ensures both data accuracy and security. The latter is guaranteed by End-to-End SSL encryption. Accuracy can be reinforced by custom Field Labels, Placeholders (value as an example displayed), and even a Tooltip text to pop up whenever a customer hovers over a field explaining it further.

You can preview your newly created ACH Authorization Form, before sharing it, from any device (desktop, mobile, and tablet) to test its performance. Rest assured you can edit it or update it whenever needed.

2. Automating ACH Authorization Forms

Having ACH Authorization Forms available online will already save you time and eliminate paper format issues. But MightyForms can empower your forms to go beyond and streamline the entire workflow.

Right off, you can enable an automatic notification by email or SMS to be sent to you or anyone in your team in charge of processing ACH payments, so no time is wasted. You can also check the option to automatically send back a PDF copy of the ACH Authorization Form as an attachment in the notification email: one for who’s responsible for filing them in your company and another one for your customer, for their file since they’ll need a copy as well.

Improve your customer experience by enabling the Save & Resume feature. ACH Authorization Forms require detailed information that the respondent might not have handy or by heart. Customers can save their progress and finish the form later, from whichever device. But even if they fail to save it, MightyForms offers the Abandoned Form Recovery feature, so you can retain and track whatever was filled out even if not submitted. You can then set up an automatic notification to warn them that the form has not been completed.

3.Collecting signed ACH Authorization Forms

Once your ACH Authorization Form is designed and empowered with advanced options, it’s ready to be published and shared. You can share its link via email or social media. If you’d prefer, you can embed it into your website or simply add the link to it on a button.

From the MightyForms dashboard, you’ll be able to access all submissions. More than just collecting signed ACH Authorization Forms, you can also collect valuable form analytics and data about your audience. Get insights about your form and what needs to be improved in order to ensure data accuracy or time spent filling it out.

4.Managing and filing ACH Authorization Forms

By automating your ACH Authorization Forms workflow you’ll be able to handle business growth and scalability. Because it’s easy to manage and archive a few signed forms, but a lot more complex when you have thousands. And we hope you do.

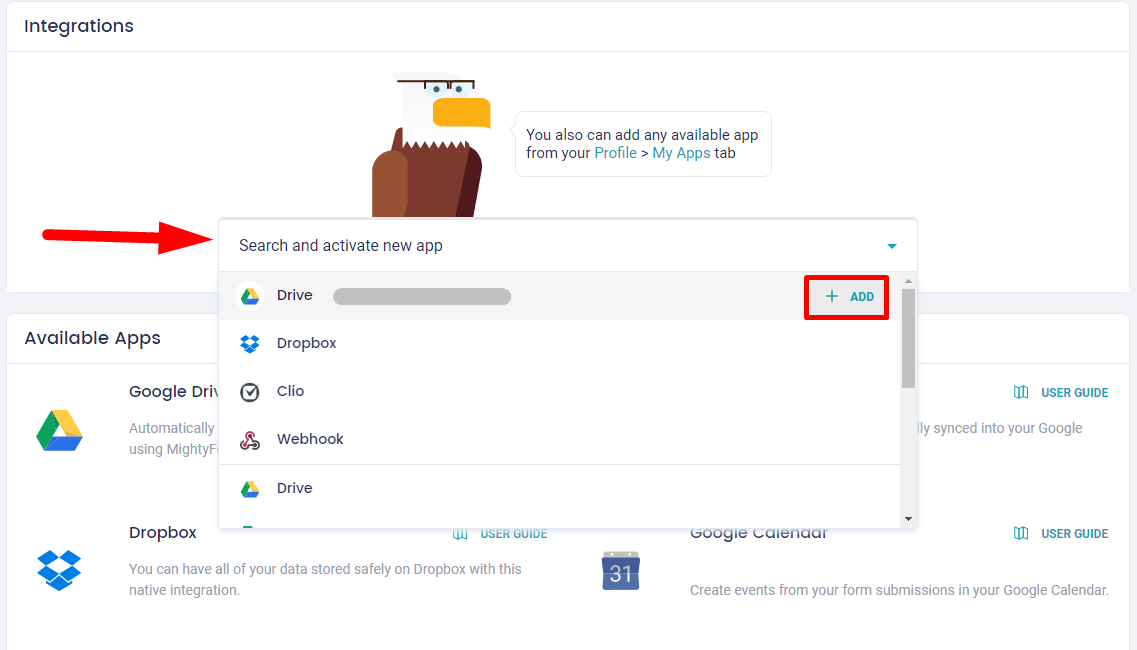

Easily and automatically integrate all your signed ACH Authorization Forms to Dropbox as a PDF file for instance, for safe cloud storing. Or export all data as a CSV file or to Google Sheets for faster data entry for ACH Network payment processing.

In case you need to print a specific ACH Authorization Form, you can easily access and print any submitted form as a PDF File. Or you can do it in bulk with all signed forms.

If you use a specific online accounting platform for processing payments or filing ACH Authorization Forms, set up a seamless connection through Zapier.

Reliable, fillable, signable, and automated ACH Authorization Forms by MightyForms will ensure liability and compliance to all your ACH payments. Cut off time-consuming bureaucratic tasks and accelerate your business!